Ruminating on seven thoughts after a torrid first half of the year:

Cash in the Mattress and Stocks in a Drawer

“Put your stocks in a drawer.” Imagine doing that on Day 1 of Q2 and pulling them out for the first time last week. “Man, we had a heckuva quarter!” LOL.

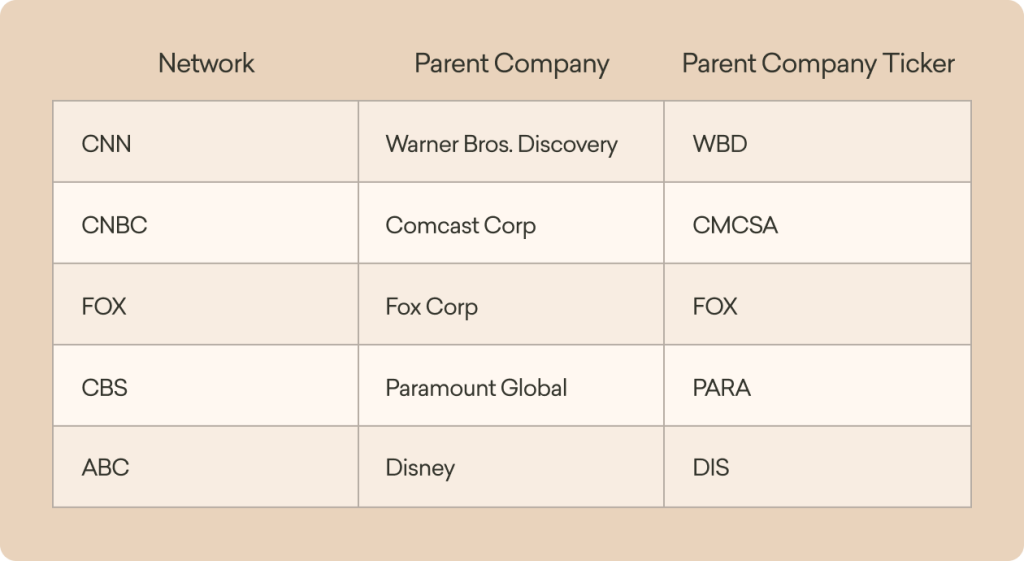

The Media’s Fiduciary Duty

Below is a table of major news networks, their parent company’s name, and stock ticker:

How do media companies make money? Advertising revenue.

How do they get companies to pay more for their ads? Why do Super Bowl ads cost so much? Because they get a ton of viewers.

How do you keep viewers coming back? You create chaos, action, fear, the idea that the viewer cannot miss what’s coming next.

The media has a fiduciary duty and it is not to you.

Telling you to buy the S&P and sit on your ass is actually in direct contradiction to their fiduciary duty to shareholders.

Herein lies the investor’s paradox:

Media thrives on drama, emotion, and impulsiveness.

The market rewards the complete opposite.

So choose: their revenue, or your return.

Is Yale’s Acceptance Rate Too High?

Over the past month, I’ve heard three legendary investors cast doubt on the Yale Model, an investment approach made famous by David Swensen. Also known as the Endowment Model, it earned prestige because it worked—Yale consistently outperformed its peers under Swensen’s leadership. Back then, Yale was an outlier. Soon after, Yale became a playbook. But 20+ years on, with copycats everywhere, the edge seems to have dulled and for many institutions, the hope for superior risk-adjusted returns appears to be fleeting.

The core of the Yale Model is a heavy emphasis on private, illiquid assets—private equity, venture capital, hedge funds—where information asymmetry and access once offered an edge.

Anecdotal, I know, but try this thought experiment with a few small business owners:

- What if I took 2% of the equity of your business—could you still scratch a great living?

- Nice. Resilient. What about that plus 20% of your profits? Still good?

- Ah, teetering. Okay—one more thing. We’ll also take out a $1M loan at 10% interest to really grow this business. You’re good to cover that too, right?

Healthy skepticism is necessary—especially when every advisor gets 15 emails a day about “alternatives.” Large institutions are slowing their roll in private markets, and exits remain tight. So, where will the new capital come from? Simple: bring privates to the retail public.

The barbarians at the gate are hungry.

Vol Works in Both Directions

Ben Shapiro was on the All-In Podcast on April 4th and knew Liberation Day was coming all along:

“Bessent said it [tariffs] to us during our interview. Lutnick said it to us as well, and no one took them seriously. I did—by the way, I absolutely did. I took them totally seriously—so much so that I called my financial advisor after the State of the Union address and told them to rejigger my stock and bond ratio in my portfolio because I figured something like this was going to happen.

You went heavy on Treasuries?

Yes, I did. I went light on stocks. And the reason for that is because—again—I think the thing about President Trump is that while he may not be serious about every single thing he says, when he repeats something over and over, there’s no hidden motivation.”*

An update from Ben Shapiro would be nice. I wonder if he likes the TACO trade. What do they say? Don’t count your chickens? The permabears never hibernate.

Allocation or Collection?

A client came in with a special account a few months back. The client’s former advisor had put together a “complex strategy that would help them to generate cash flow while managing risk.” Fair enough, I thought to myself.

As I opened my browser, the account was spilling over the sides of my screen. I zoomed out and proceeded to click through 6 pages of mutual funds, ETFs, stocks, individual bonds, and options. “So, what do you think?” the client asked.

6 pages of tickers, 50 tickers a pop, 293 positions. This “portfolio” ceased to be a portfolio long ago. It is now a collection, a horde, a pile of rubble perhaps, but definitely not a strategy. There’s a clear line between name diversification and complete chaos. I’m afraid that line was crossed a while back.

This is what I wanted to say.

“Let me dig a bit deeper and send a follow up Loom with thoughts.”

Figured I’d take the high road and save the story for a better day.

The Two Shoe Salesmen

There were two shoe salesmen who visited an underdeveloped country. One cabled his office: “no prospect of sales because nobody wears shoes here.” The other salesmen cabled: “send stock immediately–inhabitants barefooted and desperately need shoes!”

Elegance in Simplicity

While catching up with my buddy Dane Barnes, co-founder of Shibumi, I made the comment that we believe there’s elegance in simplicity when it comes to investing. He laughed. “You know what Shibumi means in Japanese?” He’d told me this before, somehow I’d forgotten.

Elegance in simplicity, but complexity feels smart. Most people think simplicity = less. No, simplicity frees us up to do more. More of what fills our cup. More signal, less noise. A reframing of simplicity and a Reframing of More.

–

Let’s get after it this week!

Brooks

Brooks Palmer, CFP® is Head of Investments at Root where he helps identify, evaluate, and implement investment solutions tailored to clients’ needs. In Full-Court Press, he breaks down what’s happening in the markets—cutting through the noise and jargon—while connecting it to Root’s core investment tenets so you can make the most of your money and your life!

Advisory services are offered through Root Financial Partners, LLC, an SEC registered investment adviser. This content is intended for informational and educational purposes only and should not be construed as personalized investment advice or a recommendation to buy or sell any security. Any forward-looking statements, including expectations about market returns, are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future performance. Past performance is not indicative of future results.

*While public figures occasionally share portfolio moves, these anecdotes are not investment advice and rarely account for the full financial picture.