Every market cycle eventually produces a moment where skepticism is treated as ignorance. Where it becomes evident that “if you don’t buy ____, you don’t truly understand this market,” and we know “conventional wisdom” is being thrown by the wayside. The ____ represents a product or strategy that somehow delivers substantial upside potential with limited “risk”. This is precisely the time to stop and glean as much as one can from history…for it is bound to repeat or rhyme sooner or later.

Right now, it feels like that blank could be filled in with AI: “if you don’t buy AI or AI stocks, you don’t truly understand this market.” That’s certainly what I am hearing from the majority of tech industry leaders, Wall Street analysts, and growth managers. Yet, there is also a refrain of bubble potential from traditional financial media, the mainstreet investing public, and “value” investors that collectively align with Charlie Munger’s quip: “there is no investment idea so good that you can’t ruin it by raising the price higher and higher.”

Whether AI turns out to be as big and important as many in the tech realm believe, there’s much more to investors “understanding this market” than the constant dissection of outlooks and earnings for the Mag 7.

The Flipside of All This AI Hype

Sometimes it feels like “AI-driven efficiency” is just out there in the ether, no one really knows what it means yet most companies in the market claim to be harnessing it.

Imagine you run a trucking logistics company responsible for getting freight to major cities efficiently at a low cost. There’s an 18-wheeler hauling a load from Atlanta to Nashville, but the driver and rig are based in Atlanta. The return trip often happens with an empty trailer and wasted capacity. There’s almost always demand from customers needing freight moved and available trucking capacity, but the task of linking the two within minutes and quoting a price that is both profitable for your company and likely to be accepted by the shipper takes time and diligence.

Customers frequently call needing “two 18-wheelers ASAP from Nashville to Atlanta,” and it could take 15–45 minutes to produce a quote. The outcome is okay, you’re making a reasonable profit, but you only quote about 60% of inbound requests at all.

You’ve been learning more about major LLM providers: OpenAI, Gemini, Claude, and the like. You’re on vacation, sitting in an adirondack chair when you hear a quick-twitch rustling of the branches down the hill. A deer darting through the forest. If only your logistics company had the flexibility to change direction at the snap of a finger. Then it dawns on you and you pry yourself up from the depth of the chair: embed AI in the quote production workflow and let it run. Input the data as soon as you have it, compare that to the mountains of other, real-time logistics data, synthesize it, and produce actionable, accurate quotes in moments. Your team implements this in August and by the time September rolls around, you are now quoting 100% of inbound requests in a matter of seconds. It has drastically improved conversion, responsiveness, and utilization while simultaneously decreasing costs.

The company you run is C.H. Robinson. After reporting all of this on October 29th, C.H. Robinson stock jumped ~20%. Wowza.

Over the next year, are occurrences similar to this one likely to increase, decrease, or stay the same? Given the pace of AI development and application, I find it very hard to believe “decrease” is the answer.

I also like the framing that:

- A business is just a collection of people trying to solve problems one after another

- Problems are just opportunities in work clothes

As an investor, I am confident that the many businesses we own are looking at the problems (opportunities) they face and asking: how can this tool, that at a minimum is unbelievable at synthesizing vast amounts of data across multiple platforms, help us better deliver the goods and services we produce for our clients? If any management team legitimately asks that question, they’re likely to consider how AI can impact their operations. Put simply: if a business is a collection of people trying to solve problems one after another and I give you a tool to help increase your speed of problem solving…that is likely to be accretive to the value of the business. AI-driven efficiency.

Here Comes the Boom…or Bust

Howard Marks’ Memos are required reading for most allocators. The Memos effortlessly weave current market events with timeless investment tenets that inform his and Oaktree’s investment approach. Cockroaches in the Coal Mine is no different:

“Risk tolerance, FOMO (fear of missing out), inadequate due diligence, and fevered buying provide fertile soil for financial scams. In heady times, rather than say, “That’s too good to be true,” people are more likely to ask, “How can I get in on that?”…

I don’t think today’s issues are systemic in the sense that there’s something wrong with the lending system, or that they will trigger other defaults and lead to a breakdown of the system. In simpler words, there’s nothing wrong with the plumbing. But imprudent loans and business frauds often occur in clusters for the simple reason that people who make investments and loans are highly prone to error in good times. Investors and lenders are supposed to be risk-averse and thus exercise discipline and vigilance, but sometimes they fail in this regard. This isn’t part of the plumbing of the financial system but rather a regularly recurring behavioral phenomenon. So, it isn’t ‘‘systemic,’’ but it is “systematic.””

While Marks’ comments are geared toward debt investors, there is a throughline to equity investing and human behavior writ large:

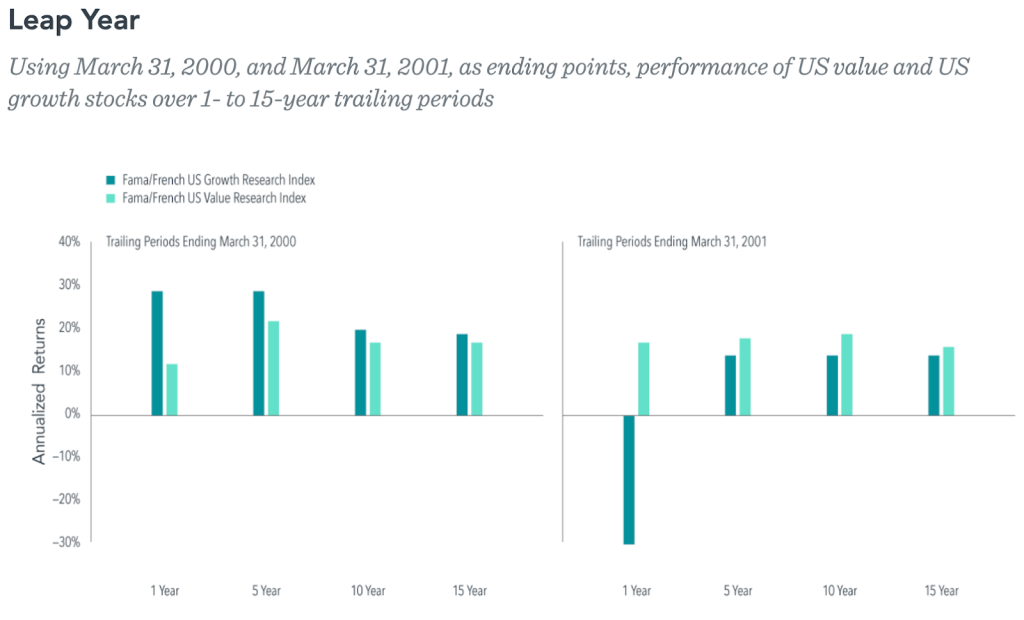

The reaction to a great run of performance in a specific asset class (US Large Cap Tech) typically provides “fertile soil” for a downdraft–whether it be relative or absolute with no way of knowing when. This should not be taken as a bearish outlook nor is it to say that the spend on AI has gotten out of hand…in fact, return on invested capital (ROIC) has increased steadily for the major LLM providers. It is to say that as soon as investors train their eye on one or just a handful of companies and assign phrases like “can’t miss”, “winner take all”, or “the clear leader” my disruption antenna go up and I’m quickly reminded why diversification has been the most reliable path to creating wealth in the markets.

Clients have asked on several occasions, “what is our exposure to AI?” I suspect investors were asking a similar question in 1999 and 2000: “what is our exposure to the internet?” At the time, not being labeled an “internet company” did not prevent businesses from benefiting enormously from the internet’s adoption. In the same way, a company does not need to be explicitly branded as “AI” to benefit from AI-driven productivity and innovation. Root is not an internet company, yet we rely on the internet for nearly everything we do.

The C.H. Robinson example matters not because it validates AI as a theme, but because it is a non-AI company that simply identified a way to improve its business. It is now producing faster quotes, better asset utilization, lower costs, and higher returns on capital. Durable value is being created.

That same dynamic could very well play out across hundreds of businesses most investors don’t associate with AI: logistics firms, manufacturers, distributors, service providers, insurers. These companies don’t need to be “AI” to benefit from it any more than they needed to be “the internet” to thrive over the last 25 years.

That’s why the concept of an AI bubble seems frustratingly narrow. History shows that a bubble can burst, and investors can still have a robust investment experience provided they did not fall victim to “FOMO (fear of missing out), inadequate due diligence, and fevered buying” leading up to the pop. So much easier said than done but like most things in life, the hard way is often the right way!

AI is likely to reshape large parts of the economy and when it does, the impact may at times be bigger on non-AI company operations, just like in the case of C.H. Robinson. The debate over bubble or not has gotten louder in the last handful of months. Hopefully when you hear, “if you don’t buy ____, you don’t truly understand this market,” you can smile, nod, and carry on.

CONSIDER

Maybe I am a sucker for self-help, but I’ve asked for my fair share of advice over the years. A pet peeve of mine is when someone recommends “find your passion.” It’s not helpful. When I hear that now, I just think “fall in love with the process.” Because even though I was never going to make money playing ball, I loved the process of getting better at basketball so much that I continue to do it for free to this day.

In Silicon Valley, many will recommend asking all the tech nerds what they are spending their weekends doing, then you’ll know what’s on the frontier. A different form of falling in love with the process. How do you spend your free time? Actions speak louder than words and provide a great indicator of passion.

I know that for my girlfriend, no amount of money would get her in a basketball gym for 6 hours a week. It’s just not fun. So a pretty simple test (provided you have given reasonable time and a good faith effort) is, do I understand how to get better at ___ and do I enjoy getting better at ___, even if no one cares?

If that doesn’t resonate, perhaps these ideas will:

“Do I want to go on this journey even if I never get to where I’m going?” – Mike Rockefeller on starting a company.

“The journey is better than the inn.” – Cervantes

“To travel hopefully is a better thing than to arrive.” – Robert Louis Stevenson

–

Let’s get after it this week!

Brooks

Brooks Palmer, CFP® is Head of Investments at Root where he helps identify, evaluate, and implement investment solutions tailored to clients’ needs. In Full-Court Press, he breaks down what’s happening in the markets—cutting through the noise and jargon—while connecting it to Root’s core investment tenets so you can make the most of your money and your life!

Past performance is not a guarantee of future results. Actual returns may be lower. Data on C.H. Robinson is as of 10/31/25. All rights reserved. The Fama/French US Growth Index and Fama/French US Value Index represent academic indexes that are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.

Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The examples provided are hypothetical and for illustrative purposes only. The information presented should not be construed as investment advice or a recommendation to buy or sell any security or implement a particular strategy.

Advisory services are offered through Root Financial Partners, LLC, an SEC registered investment adviser.