The debate over “the best way to invest”…active vs. passive, public markets vs. private markets, concentration vs. diversification…they all usually lack perhaps the most crucial component: post-tax return. The precise item that investors actually take home. It is difficult for large asset managers to opine on this because they do not want to venture into the realm of tax advice. That should not undermine its importance.

Maybe we need to flip the standard question individuals ask on its head:

- Standard – How do I outperform the benchmark?

- New – If I want to achieve a rate of return that is equal to or better than the benchmark after I pay taxes, what’s the best way to do that?

The implication, though it may not be evident at first, completely changes the approach for taxable investors (you and me).

For one, it eliminates comparisons to institutions. Imagine handing your money to a wealth manager who prides themselves on investing like institutions who do not pay tax. “Our proprietary investment approach is based on the well-regarded endowment model, revolutionized by legendary investor David Swensen at Yale University.” Ha! Okay!

Secondly, it adds the critical, final component to the investment conversation: what type of return or income do I receive from this investment? This may seem like a footnote to most, why would the type matter more than the number? But that can make a world of difference when it comes to what a client actually takes home! Interest, qualified dividends, W2 income, capital gains, and depreciation are all taxed differently so the type of return matters tremendously in determining what ends up in a client’s account.

Without diminishing the importance of investment diligence, let’s focus on the tax considerations an investor may account for when evaluating a portfolio:

Ways to (Likely) Increase Returns:

- Invest in productive public companies

- Loan money to productive public companies

- Loan money to the government

- Invest in productive private companies

- Loan money to productive private companies

- Acquire or develop real estate that produces cash flow or can be sold later for more

- Purchase or develop commodities that can be sold later for more than they cost to acquire or produce

Ways to (Likely) Decrease Taxable Burden:

- Make less in income or lose money on an investment

- Realize Capital Losses (Tax-Loss Harvesting)

- Donate/Gift to charitable organizations

- Deductible interest from various loan types

- Be a “Trader” and have some investments that lose. “Trader” in this scenario is a technical term with very specific requirements. This situation would create Ordinary Losses.

- Depreciation on certain assets

- Lose money gambling

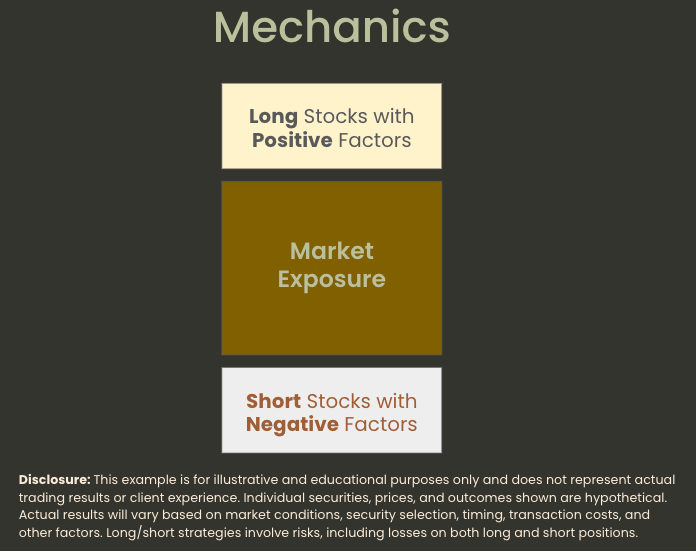

Here’s the kicker: not all of these are mutually exclusive. For instance, let’s take what’s called a Long/Short SMA which:

- Invests in productive public companies

- Borrows against those investments to create long and short extensions with a portion of the borrowing considered deductible interest

- Net, this account provides exposure to the stock market, but it also provides the ability to realize capital losses regardless of market direction

Referencing the illustration above, if the market goes up, the short positions likely lose value while the long positions gain value. In this case, the short positions will be closed (realize the loss and reinvest in new short positions), so the result is a tax asset plus potential market growth from the market exposure and long positions.

If the market goes down, the short positions likely gain value while the long positions lose value. Now the reverse occurs, sell the long positions (realize the loss and reinvest in new long positions), so the result is a tax asset plus market participation (down about as much as the overall market being tracked).

The proposition is a diversified investment in productive public companies plus the likely opportunity to harvest capital losses regardless of market direction. The Long/Short SMA addresses one area that can help increase lifetime returns and two areas that can help decrease the taxable burden through just one investment vehicle. While this is not free to implement, the benefits can outweigh those costs provided the right client situation.

This is one tool of many that advisors serving HNW clients at an elite level are capable of wielding. When we step back and ask a different question, a better question, it becomes evident why the financial planning, investment, and tax planning conversations must be intimately intertwined to effectively serve clients.

CONSIDER

“For reasons I have never understood, people love to hear the world is going to hell.” – Deirdre McCloske

“The real tax is society forcing otherwise productive people to pay attention to politics.” – Naval Ravikant

We see it in the financial news all the time: because pessimism sells, and the bear case always sounds more intelligent. Yet optimism is what pays off over the long run.

–

Let’s get after it this week!

Brooks

Brooks Palmer, CFP® is Head of Investments at Root where he helps identify, evaluate, and implement investment solutions tailored to clients’ needs. In Full-Court Press, he breaks down what’s happening in the markets—cutting through the noise and jargon—while connecting it to Root’s core investment tenets so you can make the most of your money and your life!

Illustrations and index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results.

The examples provided are hypothetical and for illustrative purposes only. The information presented should not be construed as investment advice or a recommendation to buy or sell any security or implement a particular strategy.

Advisory services are offered through Root Financial Partners, LLC, an SEC registered investment adviser.